FBS Affiliate Program

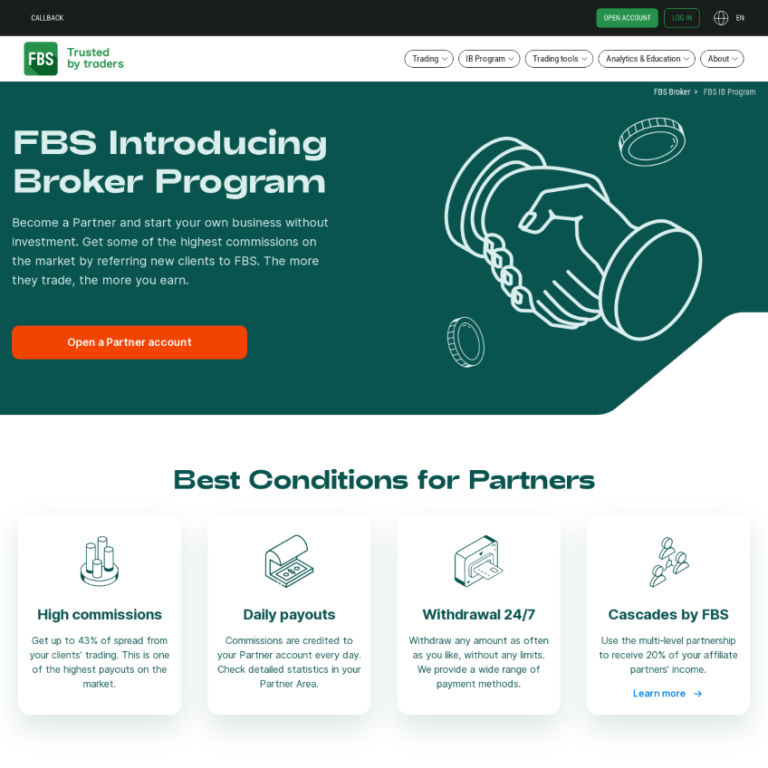

Welcome to our in-depth review of the FBS Affiliate Program. If you’re looking to venture into affiliate marketing within the forex trading industry, FBS offers a promising opportunity. In this review, we’ll delve into the features, benefits, and potential drawbacks of the FBS Affiliate Program, providing you with valuable insights to make informed decisions.

FBS Affiliate Program Review

Affiliate marketing in the forex trading sector has gained immense popularity due to its potential for lucrative commissions and continuous income streams. The FBS Affiliate Program stands out as a prominent option for affiliate marketers looking to collaborate with a reputable forex broker. Let’s delve into the various aspects of this affiliate program to understand its offerings and benefits.

1. Program Overview and Commission Structure

The FBS Affiliate Program provides affiliate marketers with a straightforward and transparent commission structure. Affiliates earn commissions based on the trading activity of referred clients, including both new registrations and active traders. The program offers competitive commission rates, ensuring affiliates can earn substantial rewards for their efforts.

2. Marketing Tools and Resources

FBS equips its affiliates with a comprehensive suite of marketing tools and resources to enhance their promotional efforts. Affiliates gain access to custom tracking links, banners, landing pages, and promotional materials tailored to attract potential traders. These tools empower affiliates to create effective marketing campaigns and maximize their conversion rates.

3. Flexible Payment Options

One of the key advantages of the this Affiliate Program is its flexibility in payment options. Affiliates can choose from a variety of payment methods, including bank transfers, e-wallets, and cryptocurrency payments. This flexibility ensures that affiliates can receive their commissions conveniently and efficiently.

4. Dedicated Support and Assistance

FBS prioritizes the success of its affiliates by providing dedicated support and assistance. Affiliates have access to a dedicated account manager who offers guidance, support, and personalized strategies to optimize their affiliate marketing efforts. This level of support contributes to a positive and collaborative partnership between FBS and its affiliates.

5. Regulatory Compliance and Reputation

FBS is a well-established forex broker with a strong reputation for regulatory compliance and transparency. Affiliates can promote FBS with confidence, knowing that the broker adheres to industry standards and regulations. This credibility enhances the trustworthiness of the FBS brand, leading to higher conversion rates and long-term partnerships.

6. Potential Drawbacks

While the FBS Affiliate Program offers numerous benefits, it’s essential to consider potential drawbacks. Affiliates operating in certain regions may face restrictions or limitations due to regulatory requirements. Additionally, the competitive nature of the forex affiliate marketing industry requires consistent effort and strategic marketing to stand out among competitors.

Conclusion

In conclusion, the FBS Affiliate Program presents a compelling opportunity for affiliate marketers in the forex trading niche. With its competitive commission structure, comprehensive marketing tools, flexible payment options, dedicated support, regulatory compliance, and reputable brand, the FBS Affiliate Program enables affiliates to maximize their earning potential and build successful partnerships.

By leveraging the resources and support provided by FBS, affiliate marketers can create effective marketing campaigns, attract a targeted audience of traders, and generate consistent income through commissions. However, affiliates should be aware of potential limitations and regulatory considerations to ensure compliance and long-term success in promoting FBS as an affiliate partner.

Overall, the FBS Affiliate Program offers a promising platform for affiliate marketers seeking to monetize their forex trading audience and capitalize on the growing demand for forex-related services.